Property Tax Relief

Tax delinquency is the single greatest indicator of property distress and can result in the displacement of limited-income homeowners. The Housing Resiliency Fund preserves Nashville’s affordable housing.

Get Help With Davidson Co. Property Taxes

Powered by Amazon, The Housing Resiliency Fund was established to help preserve homeownership for individuals and families who may be facing property distress as a result of economic instability.

Goal: To help ensure low-to moderate-income families can remain in their homes and sustain their long-term financial stability, despite a steep increase in property taxes throughout Nashville-Davidson County.

Function: The Housing Resiliency Fund helps pay for increases to homeowners’ existing property-tax bills that have occurred since the most recent reassessment of Davidson Co. property values. The fund operates as a grant to individuals and does not require participants to pay back any funds received. The program is currently designed to provide one year of property-tax relief to qualifying Nashville homeowners.

Funding: As part of a focus on mitigating housing displacement and ensuring current residents can remain in their chosen community, residing in a home they can afford, Amazon’s Housing Equity initiative has stepped up as major sponsor for THRF through a generous donation to The Housing Fund.

When to Apply: Applications from Davidson County homeowners and landlords are being accepted on a rolling basis, based on funding availability.

Landlords

The Housing Fund also offers property-tax relief to nonprofits or small landlords that are providing subsidized or naturally-occurring affordable housing. This relief can be used to put funds back into rental units to maintain their affordability, or it can recoup to the landlord. If you have already paid your property taxes for the year, you can still apply and have property-tax relief sent to you in the form of a reimbursement.

How Do I Apply?

The following checklist should help you determine your eligibility for assistance with property-tax relief from The Housing Resiliency Fund.

- Is your address located in Davidson County?

- Are you the owner of the property and do you currently reside in that property? (renters do not qualify)

If the answer to either of these questions is No, please visit the website for the Office of the Metropolitan Trustee to review other options for financial assistance.

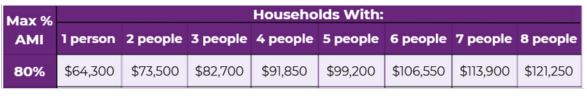

- Based on the number of people in your household, which is your income level?

- If you meet all the requirements above, you will need to gather the following documents for submission with your application:

- Bank statement

- Property Tax statement

- Current Year Tax Form 1040

- Mortgage Statement with coupon attached, if applicable

- Copy of your Driver’s License

- A utility bill- water, electric, etc.

- Other forms of verification