Community and Economic Development

What is a CED Partner?

For a CDFI like The Housing Fund, every commercial-lending project or client is unique–it just has to meet our mission of providing resources to support limited-income people and communities.

The Housing Fund’s Community & Economic Development team works with a diversity of partner types to provide loan or other support on development projects, including:

- Financial institutions interested in working with community-based organizations

- Builder-Developers

- For-profit and not-for-profit entities

- Public sector (government)

Our typical community/economic development project or client requires a short-term, bridge-lending partner. With this in mind, THF is able to customize our lending capability, products and services to each specific project.

Our clients include partners who are interested in helping low-to-moderate income populations, or fostering economic development in underserved communities. Examples of development projects include shared community workspaces, or funding to aid other nonprofits whose mission is to serve LMI individuals or communities.

Affordable Housing Financing

The Housing Fund assists nonprofit and for-profit entities in the builder-developer community who are pursuing projects to help Tennessee’s low/moderate-income populations. Commercial-lending projects or partnerships can include a variety of uses or purposes, such as:

- Land Acquisition

- Infrastructure work to prepare a site for development

- Vertical construction

- Renovations or rehabilitation of an existing structure

- Bridge or gap financing

Commercial and Facilities Financing

The Housing Fund is a mission-driven, short-term lender. We help to provide financing for affordable-housing development projects, live/work spaces for low-to-moderate income artists, and many other types of commercial/community facilities sited in limited-income neighborhoods, or that will serve LMI people.

The Housing Fund works hand-in-hand with a builder on construction or rehabilitation of their development project, until it’s fully complete. At full stabilization, THF connects clients with a conventional commercial lender to help ensure a project’s long-term financial stability and viability.

What People Say

What We Look For in a Commercial Partner

The Housing Fund works with commercial partners that are interested in serving limited-income people and neighborhoods, and that have a commitment to furthering community and economic development.

When evaluating loan requests, our Community & Economic Development team considers each applicant’s project feasibility, management and financial strength, as well as community impact. Staff also weighs the overall impact a loan can make on the community and the applying entity.

Financial Strength

Our chief concern is the likelihood that a loan can and will be repaid. We consider the accuracy of an applicant’s cash-flow projections, and the plan for loan repayment including a commitment or letter-of-interest from a financial institution. We also consider the value of collateral, and where The Housing Fund stands relative to other lenders (lien positions).

Community Impact

Each project must significantly benefit low-to-moderate income people in terms of employment, housing, or other services provided. Applicants must clearly define the project’s goals; how those goals relate to an overall community-development strategy, are supported by the community or local government, and the specific benefits that will result.

Borrower/Organizational Strength

We consider the qualifications and experience of the borrower, creditworthiness, history with similar projects, and borrower’s ability to budget, predict and meet cash flow needs, and ability to keep timely and accurate financial records.

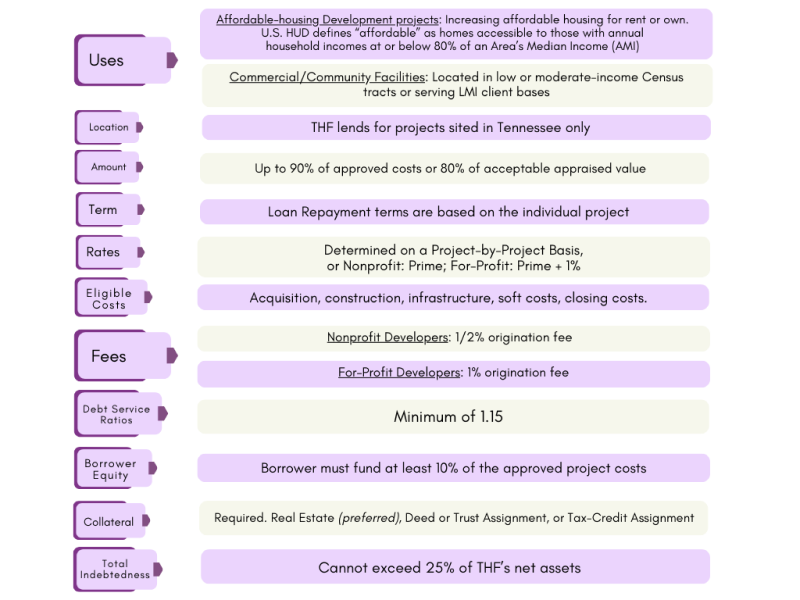

Lending Requirements

Get In Touch

Before submitting an application (PDF), please make arrangements to discuss your project with our Community & Economic Development team.

Middle TN Contact: Hunter Haislip, Credit Analyst, Community & Economic Development | [email protected] (email)

East & West TN Contact: Lou Evans, Business Development Manager | [email protected] (email)

Frequently Asked Questions

The Housing Fund supports projects to develop affordable housing (rentals or homeownership), as well as commercial/community facilities. For affordable-housing development projects, homes must be accessible to households with incomes at or below 80% of an Area’s Median Income (AMI). Commercial/community facilities projects must be located in low- or moderate-income (LMI) Census tracts, or have an adopted mission of serving LMI people.

If the project is not located within a low- or moderate-income (LMI) Census tract, it must instead serve a client base of LMI individuals.

Yes. The Housing Fund makes development loans for projects statewide, and has a strong track record of working in communities throughout Tennessee.

THF determines interest rates for our development-lending projects on a case-by-case basis.

The Housing Fund’s development loans can be used for a diverse array of commercial project needs, such as acquisition costs, construction costs, infrastructure costs, soft costs, and closing costs.

Yes. The Housing Fund has worked with market-rate, not-for-profit, and public-sector (government) entities on development projects.